Do it yourself?

Responsible, proactive and all, I still recommend you don’t attempt to manage your own rental properties. There may be some advantages to doing it yourself. If a tenant is having trouble paying the rent, you can get on to it quickly. Or if there has been damage at the property you may be more likely to keep on top of it than an agent who is managing a couple of hundred properties. But I still don’t think that outweighs the benefits of having a managing agent do it for you.

• I have multiple properties in various locations and I’m recommending you to do the same. It’s simply not worth my while (financially or personally) to handle the management issues on a day-to-day basis. I pay an average of $1,200–1,500 a year to get someone to manage a rental property – call it $25 per week. If my property is 30 minutes away from my home or office, that’s pretty much my petrol costs to go over there, let alone the time and hassle.

• I don’t want to get close to my tenants. I know I’ve talked about people and task focus (in negotiations) but there’s also the old saying, ‘Don’t mix business with pleasure.’ If you get personally friendly with tenants, it’s too easy for them to ask you to fix things up around the property or to take it for granted that you’ll understand if they fall behind on the rent. Unless you watch these things like a hawk, it’s easy for them to add up in terms of costs and hassle. How much do you like saying ‘no’ to people? Well, I can tell you that it’s much easier to say ‘no’ once through the agent who manages a number of your properties than to have to say ‘no’ repeatedly to individual tenants. If you scored high on ‘emotional’ in the business personality profile in Session 1.3, this will be especially important. This is business so don’t allow yourself to get hijacked by sentiment.

• Tenants today know their rights and generally better than their landlords do! The various bond-holding and rental authorities and tribunals tend to give the tenant the benefit of the doubt where proper written notices have not been given (and other similar infringements). If disputes end up in a rental tribunal, it takes time (and money if the tenant is withholding rent) and for investors like us, that’s all bad. A good agent is likely to be a better bureaucrat than you or I would ever want to be.

With agents it’s worth being sceptical without being cynical. Most agents are pretty good, and you don’t need to be paranoid. There’s absolutely no point having a dog (and paying it a fee) then barking yourself! But from time-to-time agents might go through a change of staff in their property management division, or they may have a few glitches in their systems, and that can be costly, so it’s worth being careful, both in selecting the right agent for your portfolio and in managing the relationship with that agent over time.

Find a good agent

Here’s a checklist:

• Find an agent with a separate division or department dedicated full-time to property management, not an agent who focuses on sales and only manages when time permits.

• Find an agent who is well established, with a large, relatively long-term rent roll.

• Find an agent whose current rent roll includes a low proportion of vacancies.

• Ask the agent for references from some of their landlords. If possible, talk to some of them yourself.

• Don’t fall into the trap of going with the agent who promises you the highest rent. This is not necessarily an indicator of ability to manage a property successfully.

• Ask about the agent’s accounting systems. Find one that has systems in place to notify the agent (and the landlord) if tenants fail to pay the rent within two days of the due date. For example, a computer system that either generates a ‘remittance advice’ or a warning to the landlord.

Management services

Agree exactly what it is that the agent will do for you.

• Vet all applications for residential tenancy. This is very important and if you’re not using an agent, it’s one of the most important things you’ll need to do yourself.

The two key questions are:

• Where have the prospective tenants lived for the last five years and did they get their bond back when they left?

• Do they have jobs and solid credit ratings?

The agent really does need to do the credit checks and confirmations with employers and landlords. If the information isn’t available, the tenant may simply be too risky to take on. (If you identify tenants who have been ‘trouble’ in a previous property, don’t touch them. There’s another old saying: ‘Better an empty house than a bad tenant’).

• Supply you with a fully-itemised monthly statement of income and expenses so that you can manage your cash flow.

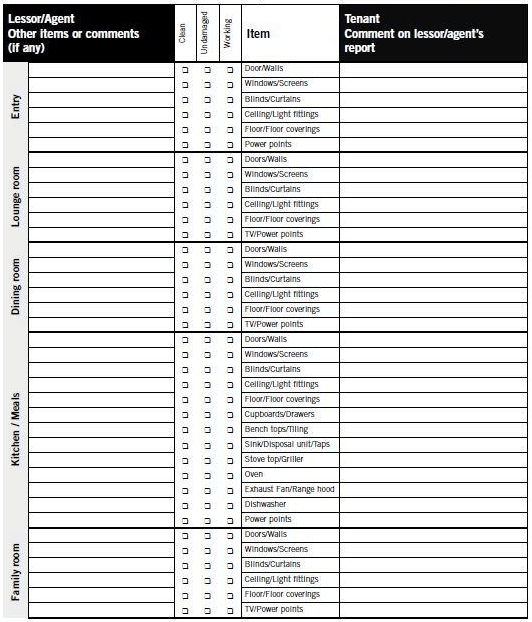

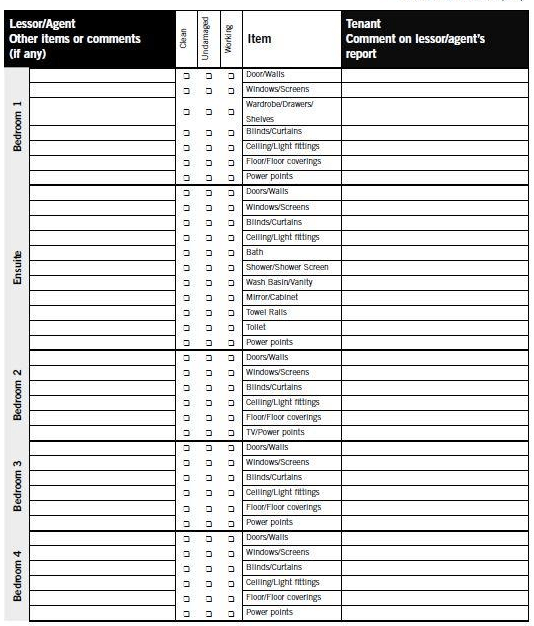

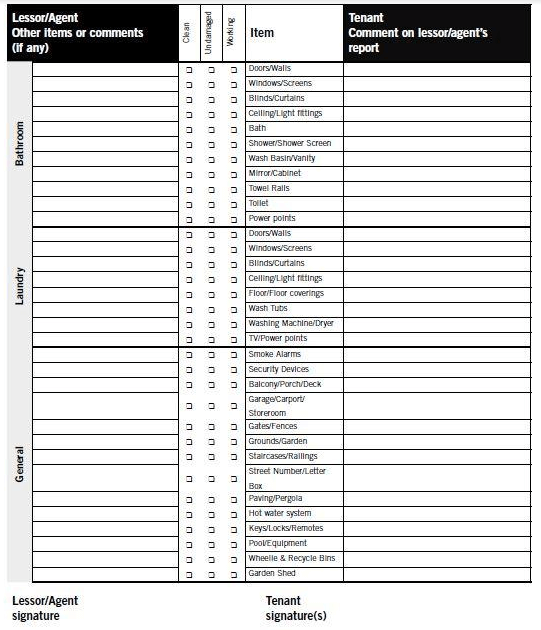

• Conduct full internal and external property inspections prior to letting and every three months, along with photographs of the property and a written report. At the end of the session, I’ve included a specimen property inspection form. It’s really the minimum information you need and I do recommend three-monthly inspections. If you are in the area, it’s not a bad idea for you to have a look through the property from time-to-time with the agent: you might pick up things the agent might miss.

• Provide direct payment of rent received (within three days of the new month) into the bank account of your choice, or by cheque posted directly to you.

• Notify you within two days if the tenant has defaulted on paying the rent on the due date. There is a general requirement under Australian legislation for agents to notify the landlord within a certain period of time, but I have often found that agents can be slack in this regard. I insist that they have a system in place. Good agents will have a computer system which automatically prints out a letter to the landlord should the rent not be banked within two days of the due date.

• Lodge all rental bonds with the Bond Board (or equivalent) on behalf of the tenant. You should get all tenants to lodge a rental bond, equivalent to at least one month’s rent. Check with your agent what the central bond holding body, if any, is in your state.)

• Pay all accounts (with your permission and on your behalf) and attend to all leases and notices pertaining to the property.

• Liaise with all trades people and inspecting all work prior to payment.

• Remind you of ongoing matters that may require your attention. For example, insurance, or general maintenance items (such as regular pest control, or cleaning of the gutters).

• Notifying you one month before the lease expires of the tenants’ intentions. Are they going to be renewing the lease?

This is the time for you to consider whether or not you might increase the rent. Depending on market conditions and interest rates, rents generally increase slightly higher than the consumer prices index (CPI) and keep pace with between 5–6 per cent return on the value of the property. For example, I bought a property for $207,000 which originally rented for $230 per week which was a 5.7 per cent return. Two years later, the property was worth about $270,000 and rented for $280 per week which was approximately a 5.2 per cent. Although the rent had gone up by over 20 per cent – nearly 2.5 times the rate of inflation – it was justified by the steep rise in the capital value of the property. If you have bought wisely, you won’t be affected by the current ‘glut’ of units which is forcing rents down in some areas. I generally try to increase my rent at least 2–3 per cent every six months or 5 per cent per year. Increased rent means cash flow positive and cash flow positive means opportunity to duplicate.

Remember to insure

• Take out landlord protection insurance, to cover you against the risk of tenants defaulting or leaving without notice (if the outstanding amount is not already covered by the bond).

• Insure the building and contents against accidental damage, fire, theft and malicious damage by the tenant. Remember: I also include removal of debris in the case of fire, as this can cost an extra $5,000–10,000 on its own.

• Set aside a contingency fund of two months’ rent, plus the amount of the excess payable on any insurance claim. That’s usually enough to give everybody some leeway in the event of unforeseen problems.

What about the red tape?

This is one of the reasons to get the paperwork done by a managing agent. But if you want to check it out for yourself, the good thing is that this is well-trodden territory. You’re not going to have to set up any of the systems yourself. There are forms for everything and usually with lots of helpful explanatory notes and instructions for both landlords and tenants.

The residential tenancies authority in each state issues all relevant statutory forms (that is, those required by the relevant state’s legislation), including:

• entry condition report

• refund of rental bond (at the end of the tenancy)

• notice of lessor’s intention to sell premises

• general tenancy agreement

• Notice to Remedy Breach (of the agreement)

• Notice to Leave (from the landlord to the tenant)

• Notice of Intention to Leave (from the tenant to the landlord).

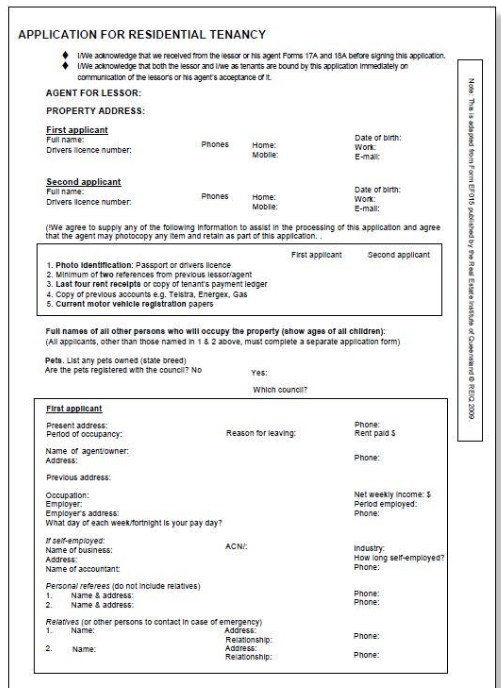

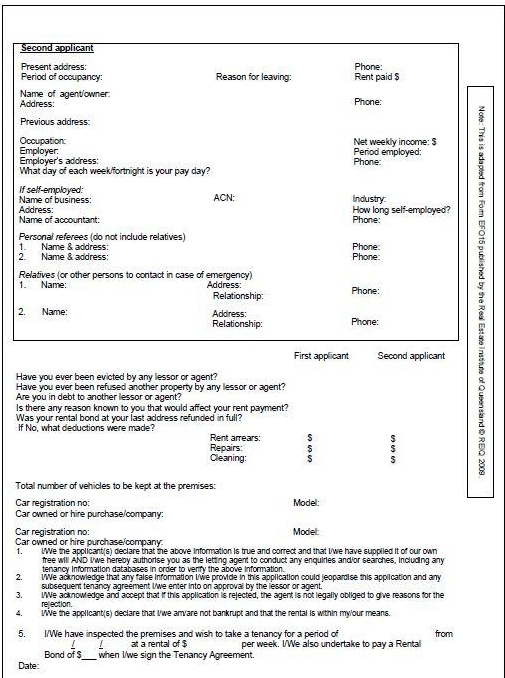

The Real Estate Institute in each state issues draft forms that agents or landlords can adapt for their own use, such as:

• application for residential tenancy

• agreement to terminate fixed term-tenancy

• inspection sheet – property and furniture

• general tenancy agreement.

>>> Coming Next: Managing Your Equity

Please note: This is an extract from the Success From Scratch – it may not contain the exercises from the full version of the book/audio set, for full version please contact us or follow our blog for more.

Thank you,

The team@Custodian